The 2020 No Surprises Act (NSA) established new federal protections against surprise medical bills and balance billing, which took effect on January 1, 2022.

For emergency patients visiting a hospital or freestanding emergency room under a state-regulated insurance plan (such as employer-sponsored commercial plans):

- If that state already has a balance billing law deemed by the federal government as meeting certain criteria, the state law will govern the OON payment amount and IDR process (if any exists in that state such as TDI IDR for Texas).

- If a state does not have such a qualifying law, then the federal law’s initial payment and IDR process governs the OON payment.

For federally regulated insurance plans (such as ERISA/employer self-funded or federal Marketplace plans under the ACA), the federal law’s initial payment and IDR process governs the OON payment amount.

Note: In some states, ERISA plans are allowed to opt-in to the state law.

The federal government has already released guidance designating some states as having a qualifying law. See below, which will be updated as more guidance comes in on the remaining states.

Learn about….

Balance Billing Laws by State

Important to Know!

Collaborative Enforcement Agreement: State and Federal government will share responsibility of coordinating and enforcing NSA provisions

Federal Government (CMS) Enforcement: CMS will enforce the provisions of the NSA in the state

Federal External Review Process: CMS will intervene on behalf of the state for adverse determinations

Federal IDR Process: CMS will enforce the provisions of the IDR process laid out in the NSA.

Federal Process Applies: CMS will enforce dispute resolution process laid out in the NSA.

How NSA IDR or Federal IDR Works

The online Federal IDR portal opened April 15, 2022. Generally, the IDR process will follow a “baseball-style” approach, following these steps.

1- ER physician submits claim to patient’s insurer. The patient is only responsible for any costs as if in-network, and is now out of the middle.

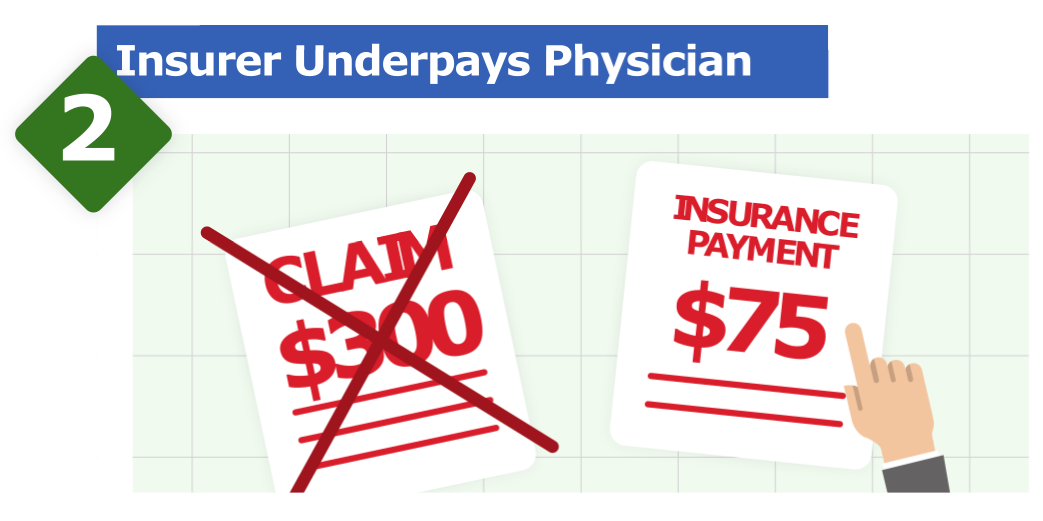

2- Physician/group can dispute the amount during the 30-day open negotiation period.

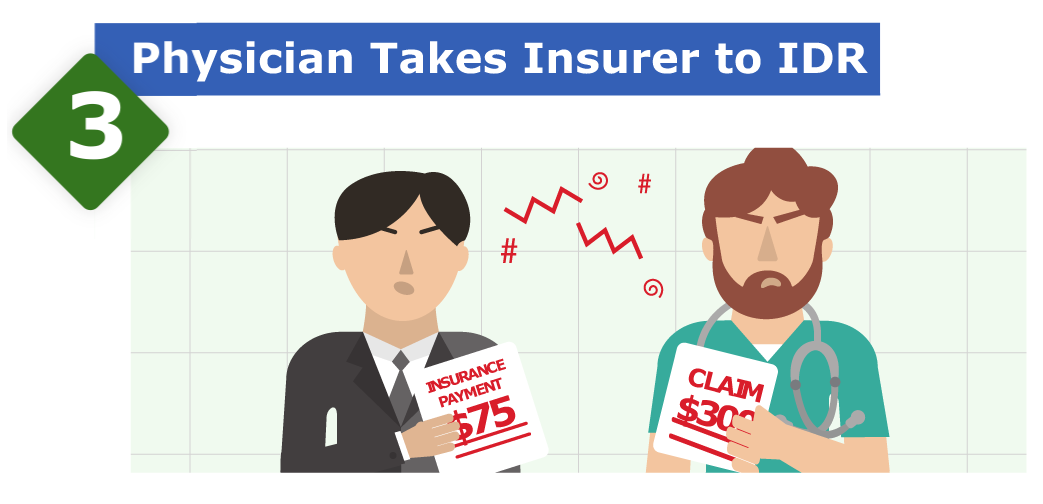

3- If that fails, either party can take the dispute to IDR using an online portal. They’ll select an arbiter/mediator from a pre-vetted list of IDR entities. Both parties must pay the IDR fee up-front ($200-500 for one claim; $268-$670 for “batched” claims of similar services with that same insurer/payer).

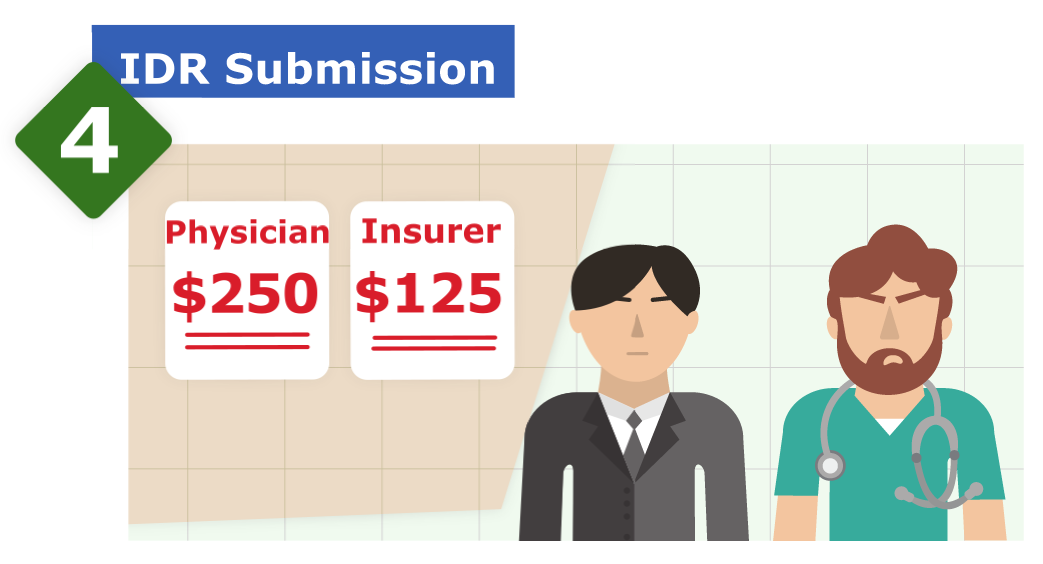

4- Each party submits offer < 10 days for reasonable payment. Offer must include:

Calculate QPA (provided by the insurer)

Physicians training and experience

Complexity of procedure or medical decision-making

Patient’s acuity

Market share of health plan and physician/group

Whether care was provided at a teaching facility

Scope of services

Any good faith efforts to agree on payment amount

Contracted rates from the prior year

5- An independent reviewer evaluates both submission and chooses one of the two payment amounts within 30 business days after the reviewer is selected. They can’t come up with their own amount; it must be one of the two proposed.

6- The loser has to make the other side whole and pay for the IDR fee within 30 calendar days. The winner gets their filing fee refunded within 30 business days.

Note: Remember, this federal IDR process will only be used for disputes for which no specified state law applies (see section below).

Learn More:

The No Surprises Act (NSA) and What It Means for Emergency Rooms

Surprise Medical Bill: New Protections for Consumers Starting 2022

NSA and Balance Billing Laws by State