The 2020 No Surprises Act (NSA) established new federal protections against surprise medical bills and balance billing, most of which took effect January 1, 2022. Below is a summary of the major No Surprises Act requirements and what they mean for you.

1- Prohibits balance billing for out-of-network emergency care (provided in hospital EDs and independent freestanding ERs) and for post-stabilization care until the patient can consent and safely be moved to an in-network facility.

2- Prohibits balance billing for scheduled out-of-network services (such as by a radiologist, pathologist, anesthesiologist, etc.) at an in-network facility when the patient hasn’t been notified or hasn’t been provided consent.

3- Prohibits insurers from assigning higher deductibles (and other cost-sharing) to patients for out-of-network than they do for in-network care without patient notification and consent.

4- Provides similar patient protections for air ambulance services, but not ground ambulances.

What It Means for Emergency Rooms

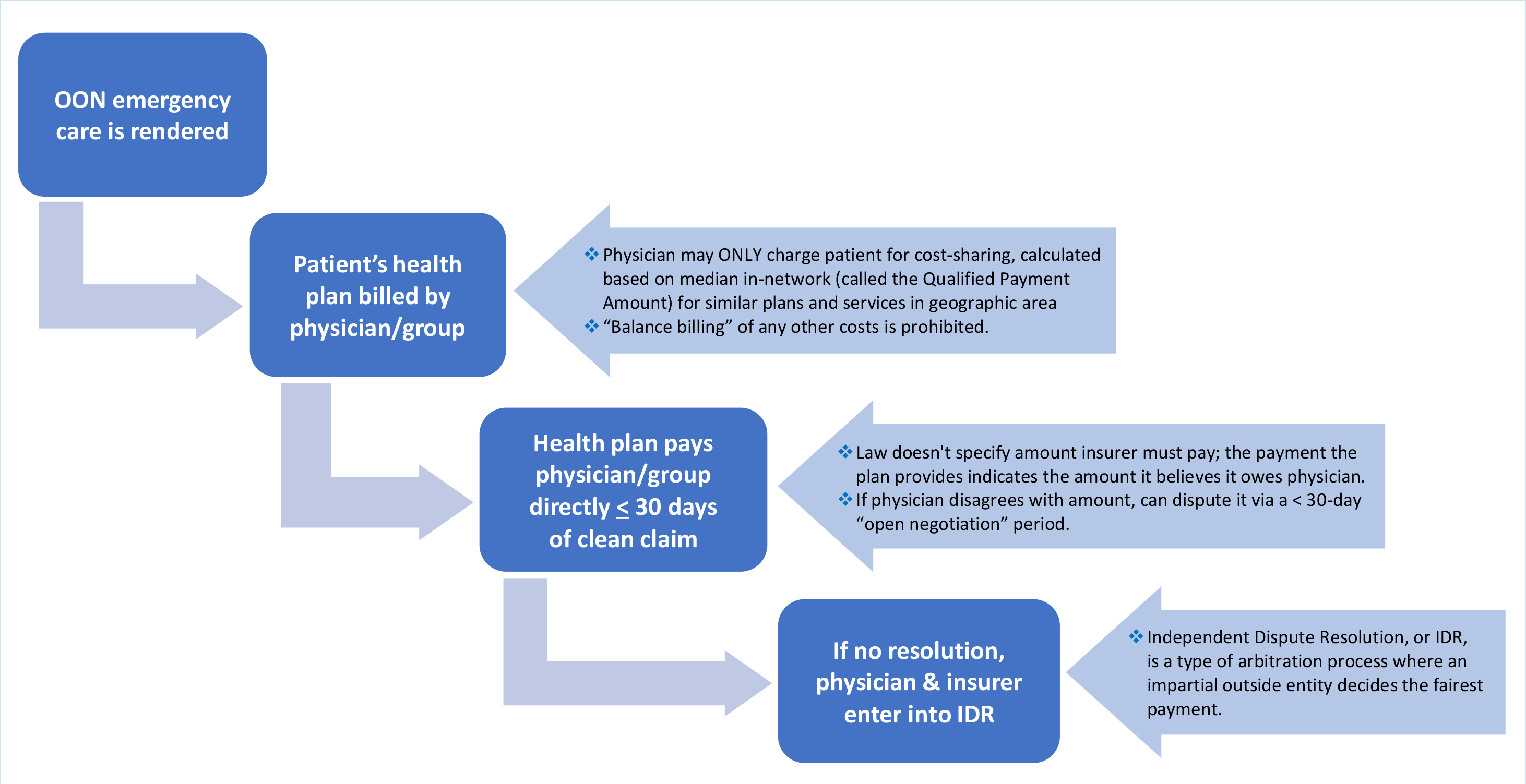

Following out-of-network emergency care, the patient’s health insurer is billed by the provider/group for the emergency services provided.

- The f/group can ONLY charge the patient for their cost-sharing amount. This amount is calculated based on the median in-network amount for similar plans and services in that geographic area (called the Qualified Payment Amount, or QPA).

- “Balance billing” by the provider/group of costs in excess of the patient’s in-network cost-sharing is prohibited.

The insurance plans must make a payment directly to the provider/group within 30 days, indicating the total amount the plan believes it owes.

If the provider/group disagrees with this amount, provider/group may dispute it with the insurer during a 30-day “open negotiation” period.

If provider/group still can’t come to agreement on a fair payment amount, provider/group can initiate the independent dispute resolution (IDR), a type of arbitration/mediation process where an impartial outside entity decides the fairest payment.

Disclosure Requirements You Are Responsible for as a Provider/Emergency Room

Providers/groups and other providers eligible under the No Surprises Act must inform all their patients about the new patient protections against balance billing.

1- Prominently at the location of the facility.

2- As a fact sheet provided to the patient either in person, by mail, OR by email—the fact sheet can be created using a template (see last page at link) provided by CMS.

Disclosure Requirements Template

3- On a facility/emergency room’s website

For emergency care, your hospital/emergency room can take responsibility for the first two requirements if you have a written agreement in place between you for this. It is recommended that the sheet be provided to the patient at the place and time of care. If your hospital does not take on this responsibility, then you must provide the disclosure fact sheet to the patient at or before you collect any cost-sharing payment from them, or at least before you file a claim with the patient’s insurer.

Good Faith Estimates

The No Surprises Act requires clinicians providing non-emergency care to provide good faith estimates of services when care is scheduled at least 72 hours in advance or upon request from individuals who are uninsured or self-pay.

You do not need to issue a good faith estimate for emergency care.

Ref: American Collège of Emergency Physicians

Learn More:

Surprise Medical Bill: New Protections for Consumers Starting 2022