Medical billing is the process of submitting and following up on claims with health insurance companies in order to receive payments for services rendered by a healthcare provider.

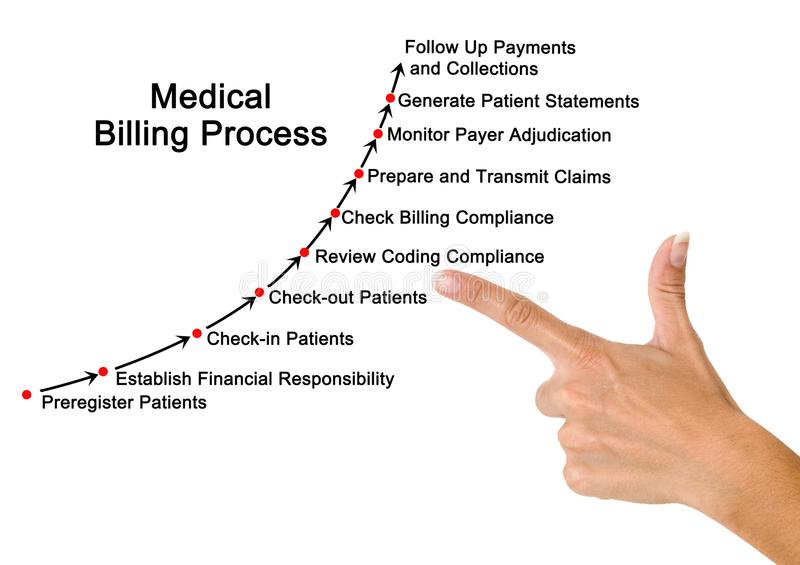

Medical billing translates a healthcare service into a billing claim. There are 8 steps we follow:

1. Register Patients

First step is medical billing process starts When a patient call to setup an appointment with a healthcare provider (doctor), they pre-register or schedule for their doctor’s visit. If the patient has seen doctor before then he or she will be an established patient and their information is on file, that person only need to explain the reason of visit, but if a person comes first time he will be called a new patient and must provide his personal and insurance information to the provider (doctor) to ensure that they are eligible to receive services from the provider. We maintain patient database by registering patients as per scheduling and make sure the security of patient’s records. And confirm insurance eligibility.

2. Confirm Financial Responsibility

Second step is medical billing process is Financial responsibility which describes who owes what for a particular doctor’s visit. Once the we have the pertinent information from the patient, we can determine which services are covered under the patient’s insurance plan.

Insurance coverage differs dramatically between companies, individuals, and plans, so the we must check each patient’s coverage in order to assign the bill correctly. Certain insurance plans do not cover certain services or prescription medications. If the patient’s insurance does not cover the procedure or service to be rendered, we make the patient aware that they will cover the entirety of the bill.

3. Patient Check-In And Check-Out

Patient check-in and check-out are relatively straight-forward front-of-house procedures. When the patient arrives, they will be asked to complete some forms (if it is their first time visiting the provider), or confirm the information the doctor has on file (if it’s not the first time the patient has seen the provider). The patient will also be required to provide some sort of official identification, like a driver’s license or passport, in addition to a valid insurance card.

The provider’s office will also collect copayments during patient check-in or check-out. Copayments are always collected at the point of service, but it’s up to the provider to determine whether the patient pays the copay before or immediately after their visit.

Once the patient checks out, the medical report from that patient’s visit is sent to the medical coder, who abstracts and translates the information in the report into accurate, useable medical code. This report, which also includes demographic information on the patient and information about the patient’s medical history, is called the “superbill.” The superbill contains all of the necessary information about medical service provided. This includes the name of the provider, the name of the physician, the name of the patient, the procedures performed, the codes for the diagnosis and procedure, and other pertinent medical information. This information is vital in the creation of the claim.

Once complete, the superbill is then transferred, typically through a software program, to us (medical billers)

4. Prepare Claims/Check Compliance

When we take the super bill from the medical coder and put it either into a paper claim form, or into the proper practice management or billing software. We also include the cost of the procedures in the claim. We won’t send the full cost to the payer, but rather the amount we expect the payer to pay, as laid out in the payer’s contract with the patient and the provider. After creating claim we ensure that the claim meets the standards or compliance, both for coding and format.

The accuracy of the coding process is generally left up to the coder, but we review the codes to ensure that the procedures coded are billable. While claims may vary in format, they typically have the same basic information. Each claim contains the patient information (their demographic info and medical history) and the procedures performed (in CPT or HCPCS codes). Each of these procedures is paired with a diagnosis code (an ICD code) that demonstrates the medical necessity.

5. Transmit Claims

Since the Health Insurance Portability and Accountability Act of 1996 (HIPAA), all health entities covered by HIPAA have been required to submit their claims electronically, except in certain circumstances. Most providers, clearinghouses, and payers are covered by HIPAA.

HIPAA does not require physicians to conduct all transactions electronically. So we make sure that the standard transactions listed under HIPAA guidelines must be completed electronically.

In the case of Medicare or Medicaid, we can submit the claim directly to the payer. If, however, a provider is not agree for submitting claims directly to these large payers, we go through a clearinghouse.

“A clearinghouse is a third-party organization or company that receives and reformats claims from billers and then transmits them to payers. Some payers require claims to be submitted in very specific forms. Clearinghouses ease the burden of medical billers by taking the information necessary to create a claim and then placing it in the appropriate form. Think of it this way: A practice may send out ten claims to ten different insurance payers, each with their own set of guidelines for claim submission. Instead of having to format each claim specifically, a biller can simply send the relevant information to a clearinghouse, which will then handle the burden of reformatting those ten different claims.”

6. Monitor Adjudication

Once a claim reaches a payer, it undergoes a process called adjudication. In adjudication, a payer evaluates a medical claim and decides whether the claim is valid/compliant and, if so, how much of the claim the payer will reimburse the provider for. It’s at this stage that a claim may be accepted, denied, or rejected.

Once the payer adjudication is complete, the payer will send a report to the provider/biller, detailing what and how much of the claim they are willing to pay and why. This report will list the procedures the payer will cover and the amount payer has assigned for each procedure. This often differs from the fees listed in the initial claim. The payer usually has a contract with the provider that stipulates the fees and reimbursement rates for a number of procedures. The report will also provide explanations as to why certain procedures will not be covered by the payer.

7. Generate Patient Statements

Once we have received the report from the payer, it’s time to make the statement for the patient. The statement is the bill for the procedure or procedures the patient received from the provider. Once the payer has agreed to pay the provider for a portion of the services on the claim, the remaining amount is passed to the patient.

8. Follow Up On Patient Payments And Handle Collections

We ensure those bills get, well, paid. We as billers are in charge of mailing out timely, accurate medical bills, and then following up with patients whose bills are delinquent. Once a bill is paid, that information is stored with the patient’s file.

If the patient is delinquent in their payment, or if they do not pay the full amount, it is the responsibility of the biller to ensure that the provider is properly reimbursed for their services. This may involve contacting the patient directly, sending follow-up bills, or, in worst-case scenarios, enlisting a collection agency.